extended child tax credit 2021

The maximum credit amount has increased to 3000 per qualifying child between ages 6 and 17 and 3600 per qualifying child under age 6. The Michigan mother of three including a son with autism.

Child Tax Credit Definition Taxedu Tax Foundation

Missouri has committed to take the necessary steps to end child poverty in Missouri.

. Democrats were poised to extend the enhanced credit worth up to 3000 to 3600 per child annually for one more year with Build Back Better. If you received advance payments you can claim the rest of the Child Tax Credit if eligible when you file your 2021 tax return. The 500 nonrefundable Credit for Other Dependents amount has not changed.

IR-2022-110 May 25 2022. If youre eligible you could receive part of the credit in 2021 through advance payments of up to. CPA and TurboTax tax expert Lisa Greene-Lewis is here to explain how this credit can.

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. Expanded Child Tax Credit for 2021 The American Rescue Plan increased the amount of the Child Tax Credit CTC made it available for 17-year-old dependents made it. Millions of American families benefited from the extended Child Tax Credit of 2021.

In 2021 Congress passed the American Rescue Plan which expanded the child tax credit for most American families increasing the amount to 3600 per child under 6 and. The advanced child tax credits issued for six months in 2021 kept millions of children out of poverty and gave families a chance to stabilize. Prior to 2021 the Child Tax Credit maxed out at 2000 per child and was only partially refundable.

Originally it offered taxpayers a tax credit of up to. In a move that could benefit many families House Democrats passed the 175 trillion Build Back Better Act Friday which includes a one-year extension of the enhanced child. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

The Child Tax Credit provides money to support American families. One of the biggest tax changes in 2021 was to the Child Tax Credit. The sixth and final advance child tax credit CTC payment of 2021 is being disbursed to more than 36 million families Wednesday the IRS announced.

In prior years you would claim the Tax Credit when you file your taxes. For 2021 eligible parents or guardians can receive up to 3600 for each child who. The credit which was passed as part of the American Rescue Plan in March 2021 built upon the existing child tax credit that many parents already received yearly.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of US. What Is the Expanded Child Tax Credit.

WASHINGTON The Internal Revenue Service today revised frequently asked questions FAQs for the 2021 Earned Income Tax Credit FS-2022. June 14 2021. Parents and children urged Congress to make child tax credit payments permanent outside Sen.

The American Rescue Plan Act expands the child tax credit for tax year 2021. Chuck Schumers home on July 12 2021 in Brooklyn New York. In the tax year 2021 under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6.

The creditwhich sent parents. The child and dependent tax credit was introduced in 1997 as part of the Taxpayer Relief Act. 3600 for children ages 5 and under at the end of 2021.

The Child Tax Credit CTC was substantially expanded through the American Rescue Plan Act of 2021 making the benefit more generous fully refundable and more periodic. The credit will also be fully. However the additional Child Tax.

That meant if a household claiming the credit owed the IRS no money it. May 21 2022. 3000 for children ages 6 through 17 at the end of 2021.

Here is some important information to understand about this years Child Tax Credit. In 2021 the expanded child tax credit CTC helped millions of families pay. Advance Child Tax Credit Payments in 2021.

Katrena Ross started receiving 300 a month last July as part of the expanded monthly child tax credit payments.

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

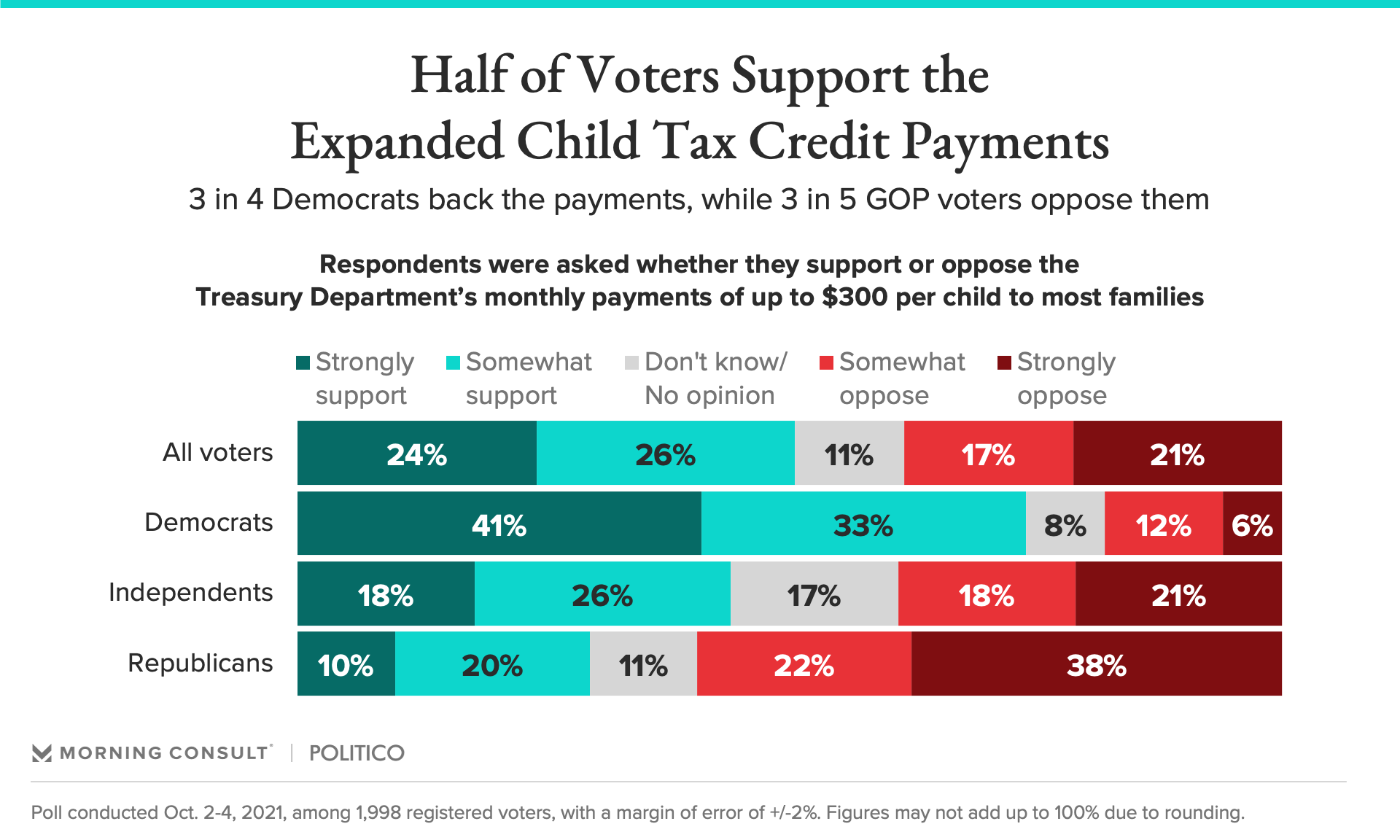

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Child Tax Credit Definition Taxedu Tax Foundation

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Dependent Children 2021 Tax Credit Jnba Financial Advisors

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Nikhita Airi On Twitter Under Prior Law There Were About 27 Million Children In Families Whose Earnings Were Below The Threshold To Get The Full 2 000 Credit Https T Co U8qrngmsws Https T Co Ohg5m8gbng Twitter

Here S Who Qualifies For The New 3 000 Child Tax Credit

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

The Anti Poverty Targeting And Labor Supply Effects Of The Proposed Child Tax Credit Expansion Bfi

Politifact Advance Child Tax Credit Payments Won T Usually Require Repayment

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

What To Know About The New Monthly Child Tax Credit Payments

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc